Category: JOURNAL

Speculation vs Investment

The Journey to Investment Success: Embracing Speculation as a Catalyst

In the realm of financial markets, the pursuit of investment success is a journey rather than a destination. This journey is punctuated by the choices between safety and risk, between contentment with the status quo and the ambition for more. The essence of this path lies in understanding that settling for low returns marks not a beginning, but the culmination of investment success. It is in the rigorous and disciplined embrace of speculation where the true adventure lies, propelling us towards our financial aspirations with a blend of effort and strategic risk-taking.

The Role of Speculation

Speculation, often misinterpreted as mere gambling, is in fact the engine of our journey towards investment success. It is the calculated risk-taking that challenges the comfort of low returns, pushing the boundaries of what is possible with our investments. Speculation is not about recklessness; it’s about informed, strategic decisions that, while carrying risk, also offer the potential for substantial rewards. This approach requires a mindset shift, to see speculation not as a threat but as a tool for growth.

The Drive Requires Effort and Results

The drive towards the finish line of investment success demands more than passive hope; it requires active engagement, effort, and a keen eye for opportunities. This effort is not just about taking risks indiscriminately but about making calculated moves that have the potential to yield significant returns. It’s about understanding the market, recognizing trends, and seizing opportunities when they arise. Such a drive is fuelled by the desire to achieve results that outpace inflation and deliver real, tangible growth in our investments.

Settling for Low Returns at the Finish Line

Arriving at the finish line of investment success means reaching a point where settling for low returns becomes a choice, not a necessity. It signifies a portfolio sufficiently grown and diversified, capable of weathering market volatility while providing stable, if modest, returns. This is the stage where the investor can afford to shift focus from aggressive growth to preservation of capital and steady income. Achieving this stage is a testament to the success of one’s speculative efforts and strategic risk-taking throughout the investment journey.

The Underlying Message: A Balanced Approach

The underlying message here is clear: the road to investment success is paved with calculated speculation. It is the willingness to embrace risk, to put in the effort, and to seek results that differentiates the successful investor from the rest. However, this does not advocate for a reckless gamble but for a balanced approach, where speculation is used judiciously as a means to achieve greater ends.

In conclusion, speculation is not merely a phase but a critical driver on the journey to investment success. It is through embracing the risks and challenges of speculation that we can push our investments to their full potential, ultimately reaching a point where settling for low returns is a marker of success, not of compromise. Let this journey be defined not by fear of loss but by the pursuit of growth, with the understanding that the finish line signifies a well-earned transition to stability and security. Keep pushing forward, keep speculating wisely, and remember: that the greatest rewards lie just beyond the comfort zone.

Loeb, Gerald M. The Battle for Investment Survival. Chapter 6, p. 32.

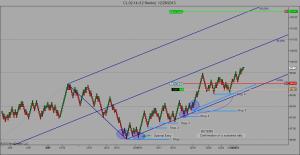

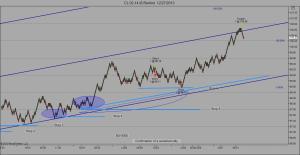

CL 02-14 using Renko 12 (12/24/13)

Risking $320 to make $3,250 for about 10:1 risk to return.

Using a Renko 12 Chart I create the Andrew’s Pitchfork using the 92.06 Low as the starting point. The 99.00 High as point 2 and the Low of 96.5 as point 3.

I compare the fit between the standard and modified shiff frequency and find the latter the better fit.

It appears that on Christmas Eve, I am late to the party as three previous entry points have since then been revealed.

Discovering the Stop

I discover multiple stops revealing buyers from the 96.5 to 97.5 price range and an area of speculative support near $98.53 (adjusted by 1 tick to $98.43).

Price is moving sideways as it waits for time to catch up with it’s move from mid December.

The stop is speculative and an attempt to find an entry on what looks to be a strengthening of price from the previous lows of $98.

Discovering the Entry

The challenge that I see when making an entry is that the current area of entry price action is making minor lower lows and lower highs; whereas previously back on Dec 19, the price action was making higher lows and higher highs. It appears this previous area is a better quality entry point.

Previous entry areas did appear to follow inside SH confirming price action strength and upholding previous consolidation lows.

As current price action showed in the Renko 6 Chart with greater detail, buyers where stepping up to weakness, therefore, an entry was made on the retest of these lows on Christmas eve, 2014 at $98.75.

This entry was sub optimal because latter price action hit the new lower SH directly and would have served as a superior entry with extreme minimal risk or the option of using a deeper stop.

Determining the Profit Target

The profit target of 102 was used as this was the upper ML at the time of entry. It has since then moved higher to compensate for the additional time within the trade.

A question arises, why not let the profit run instead of using a stop.

The value of the profit target is that it provides an exit strategy. This is a risk management decision relative to keeping profits, otherwise one can get caught in a down swing or adverse move resulting in less profit and get positioned into emotional decision making arrangements relative the exit stage of the trade.

You can more easily find an additional risk-adjusted opportunity to get in elsewhere. Whereas, opportunities to get back out…not so easy because a bird in hand is better than two in the bush.

Managing the Trade

Since the Christmas day opening, the price has advanced above the the 99.4 area and attempting to advance through 99.6 area making minor higher lows and slight higher highs.

The stop has been raised to a new area of price support compressing the risk to lock in a portion of established gains.

The stops and targets will be raised accordingly as the language of price reveals the areas of new support and movement of price along the median line until one side or the other of the trade will be hit.

EXIT

Exited the position at $100.59 for $1.84 ($1,840) per contract.

Used the Center ML as the profit target. Since the position was only 1 contract I did not have the option to exit 50% of the position, therefore, decided to exit the position on the Center ML because I could not find a market structure stop that was acceptable to me and did not want to risk getting stopped out and giving back the additional gains.

Until the next opportunity presents itself, the risk is off.